Today we are announcing Greylock 16 – a billion dollar fund.

At Greylock, our mission is to help realize rare potential. To do this well, we believe it’s essential to be trusted partners to entrepreneurs at every stage — from idea to IPO. We are committed to supporting entrepreneurs along their entire journey.

Our partnership is small, integrated and high-caliber because we believe that is the best way to serve entrepreneurs. We bring more than just capital; we bring differentiated domain knowledge, access, thoughtful deliberation and company building to the companies we back. The core of our business is supporting entrepreneurs from the earliest stages (seed, series A) and helping them build and scale. We were fortunate to have backed Airbnb, Discord, Figma, Nextdoor, and Rubrik early on. Companies like Sumo Logic and more recently Abnormal Security were conceived and initiated in our offices.

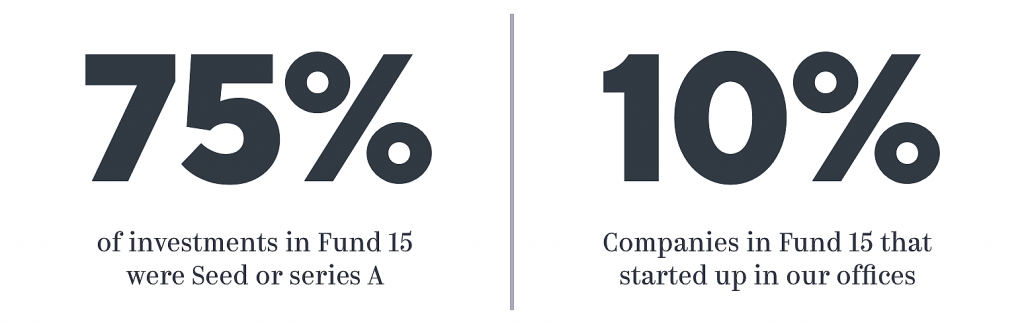

With Fund 16, we will continue our focus on early stage investing. While we primarily invest in enterprise and consumer software at Seed and Series A, the size of our fund gives us the flexibility to make new company investments in Series B and beyond including growth stages. Our fund size also allows us to support companies as a primary/lead investor through company journeys. In our most recent fund, 75% of investments made were seed or series A, and the rest were in series B and beyond. Notably, 10% of the companies we backed in our last fund started up right in our offices.

We are at an incredible moment in time for technology. Massive secular shifts in enterprises – including digital transformation, the journey to the cloud, and AI/ML era – have created a unique opportunity for startups across sectors including SaaS, productivity, data & analytics, infrastructure, security, and observability. We will continue to invest in enterprise focused products that increase productivity (Dropbox, Figma, Clubhouse), opportunities in DevOps, open-source, monitoring, metrics, logging and new management frameworks (AppDynamics, Sumo Logic, Chronosphere), and in products that make organizations more secure (Okta, Palo Alto Networks, Abnormal Security). We’ll also look for opportunities to back entrepreneurs who are building on emerging technologies like AI and machine learning (Instabase, Snorkel AI, Cresta), and we will continue to invest in health tech (Lyra Health, Solv, Cleo).

No question, technology is also impacting every aspect of consumer’s lives. We will continue to invest early in the teams who are building software to improve how consumers shop, travel, live, and play. We are bullish on consumer tech that networks people together (Nextdoor, Discord, Roblox), marketplace platforms across both B2B and B2C (Airbnb, Convoy, GoFundMe), underlying software & infrastructure enabling the new wave of commerce, and fintech replacing legacy infrastructure with technology through a combination of new software, regulation, and consumer trust (Blend, Coinbase, Oportun). We will continue to view these largely through the lens of software, and apply our knowledge and experience in these areas to help entrepreneurs build companies that matter.

We understand the entrepreneur’s journey; most of us have been down that road. We love to dig in early to help entrepreneurs build important, valuable companies. The hallmarks of a Greylock partnership are an ingrained part of our working culture. We back talented ambitious founders in the most promising markets. We are engaged, active, high-impact board members who are committed to excellence and always available to leadership teams. Founders get the benefits of our specialist team who actively help companies with customer development, executive talent, technical and core talent, and marketing. Our entire partnership structure and incentives are strongly aligned with the success of the companies in which we invest.

We are grateful for the small group of preeminent university endowments, non-profit foundations and other organizations who have been our limited partners and supporters for many decades. While it’s extremely rare for us to add new LPs, in Fund 16, we only added new LPs with a specific focus on diversity and inclusion, such as Management Leadership for Tomorrow (MLT). The returns we deliver to our LPs help fund student scholarships and social programs, as well as important research and programs in science, medicine, arts and the environment. In this way, the hard work of the entrepreneurs we partner with carries forward into positive societal impact through our LPs.

The entrepreneurs who dedicate themselves to building important companies are the true heroes of the story. They have the vision to build something huge that hasn’t existed before. They are paranoid about what could go wrong — but are obsessed with what can go right. They are mission-driven, intellectually honest and infinite learners. They have raw ambition, bravery, and grit. They don’t give up, ever. And they are unique in their ability to lead and inspire others to join their journey. Every day, we are amazed at these entrepreneurs who are bold and determined enough to chart their own paths. We are deeply grateful to the founders who invite us to share their journey, and it’s our privilege to work with them. It’s why we love what we do, and why we are always looking for the next team with rare potential.