As a wave of crypto hype and speculation tumbles to a chaotic close, it’s important to remember that the utility of the technology is not lost along with the value of a coin.

Listen to this article >

Listen to this article >

Rather, the recent high-profile failings of several crypto companies demonstrate an abuse of trust and assets made possible by the fact that the organizations were operating in direct conflict to the reason why crypto was invented: to provide a public, decentralized exchange where self-custody of assets is the default.

That core infrastructure remains, and it is still ripe for innovation.

There are many real use cases across financial services that can not only usher us into a more secure, inclusive, and efficient financial system, but also return trust and ownership to those for whom crypto was created in the first place – the users.

To illustrate how this can be done, I’ll unpack one of crypto’s most obvious use cases: DeFi lending. I believe DeFi lending will be a key driver behind taking crypto mainstream. There is currently $25 billion of DeFi lending value locked in EVM chains – which represents just a small fraction of the $16 trillion in consumer loans outstanding in the US alone.

In this essay, I’ll walk through the current system and highlight the many advantages DeFi lending has over traditional lending; identify the entry points where entrepreneurs can build; and outline areas where software architecture and regulatory frameworks must evolve in order to bring DeFi lending mainstream.

To illustrate this, I made a Tome presentation which you can view below or by following this link. The essay continues after.

How is DeFi Lending Different from Traditional Lending?

Today, DeFi lending is exclusively secured against liquid crypto assets. So, to compare “apples to apples”, let’s look at equity-backed lending in the traditional world compared to crypto-backed lending in DeFi.

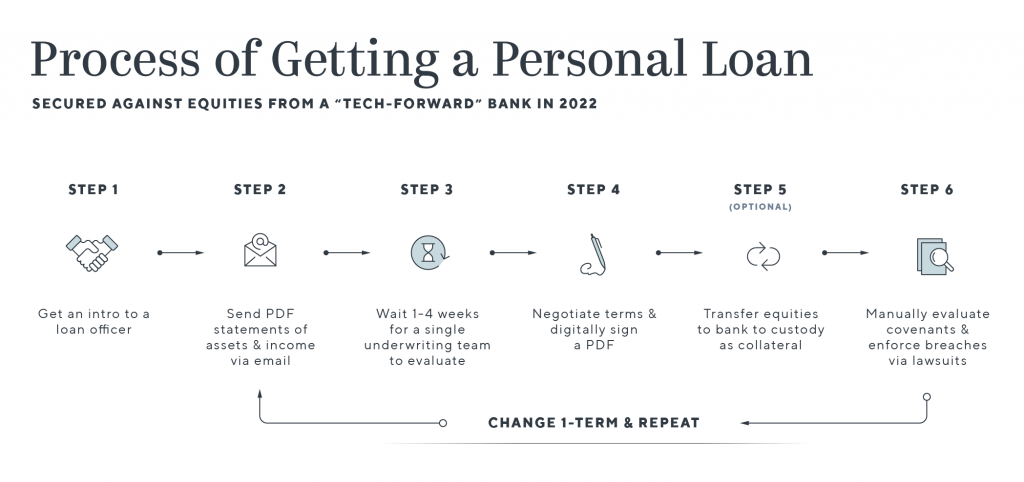

Let’s say you bought Microsoft shares 10 years ago, and they’ve appreciated significantly. Now you want to buy a house. One option would be to sell your Microsoft shares and pay up to 40% in capital gains tax. Another option would be to take out a loan secured against your Microsoft shares – known as an equity-backed loan. Today, the process of getting an equity-backed loan from a tech-forward bank (that is not also your brokerage) is painful. It includes weeks of paperwork where an underwriting team evaluates your assets and income based on PDF statements. This process is slow, expensive, and vulnerable to fraud.

How Does DeFi Lending Work?

Compared to the arduous process of getting an equity-backed loan through a bank, those who have participated in DeFi lending have experienced the “magic moment” of getting a loan within minutes through software. You press a few buttons and your assets are cryptographically verified, then collateralized via a smart contract, and then you can instantly receive money (stablecoins) that you can withdraw, transfer, or spend.

That magic comes from a simple concept: crypto is built on a shared ledger that all participants can read and write into using software. By extension, the inherent attributes of DeFi lending make it cheaper, faster, and more secure for consumers:

DeFi Lending’s Key Advantages

- Verified on-chain assets

- A marketplace of underwriting

- P2P marketplace & reduction of middlemen fees

- Contracts enforced by code

- Self-custody of assets and data

Let’s dig into each of these advantages.

Verified On-Chain Assets

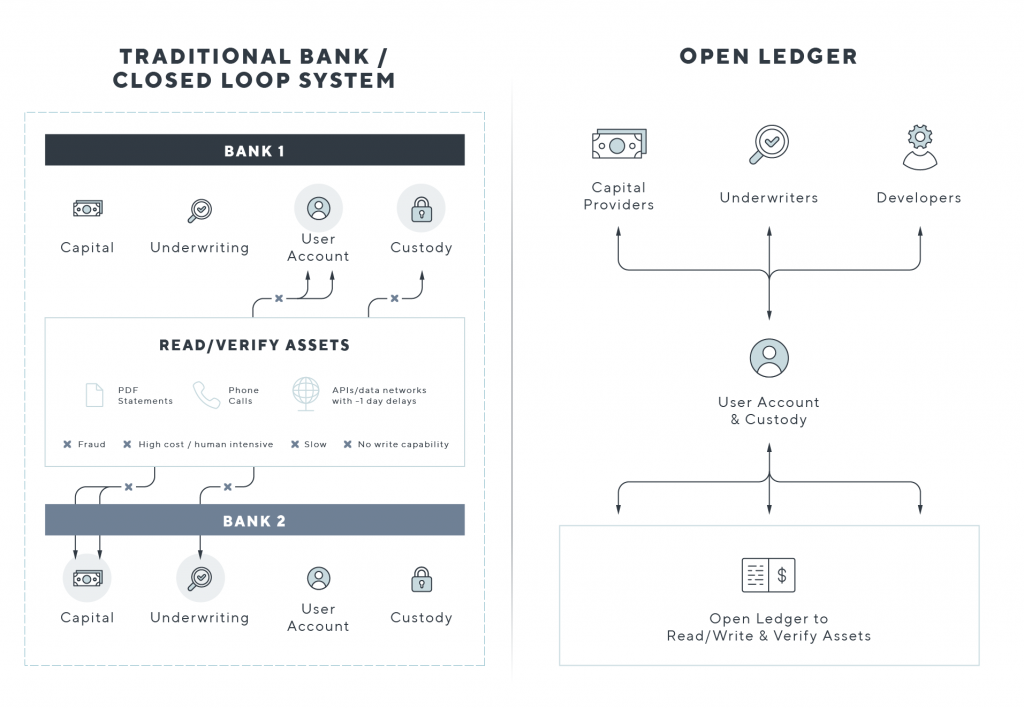

Crypto’s public ledger enables anyone to verify assets in real time and assign any type of control over those assets through code (with the owner’s permission). Compare this to the existing system.

In the traditional banking world, people often lend against assets stored in databases within closed-loop systems. That means there is no method by which lenders can evaluate assets (which can change quickly and often) in real time. If you wanted to get a loan from an entity outside of that system, you would either need to transfer custody of your assets or communicate between the systems. This is a cumbersome process that happens via PDFs, phone calls, and occasionally time-delayed, read-only APIs. Moreover, even if assets are verified, they can’t be controlled by the lender to enforce the loan contract (such as initiating a margin call) unless they are custodied with the lender. Additionally, the high operational costs, potential for fraud, and lack of competition means it’s often only practical for lenders to give attractive rates to very rich people with large loans.

In DeFi lending, assets can be verified regardless of where they are held, and owners can assign control over those assets to anyone. From there, anyone can compete to fund those assets. It’s also more inclusive to a wider pool of people: DeFi lending is available for loans as small as $5,000, with spreads much tighter than traditional lending.

Marketplace of Underwriting & Funding

Today, people are lucky to get 3 to 5 quotes for a loan for several reasons. First, the process to obtain a quote is unique to each lender. That’s not scalable, as most consumers don’t have the time to price shop across thousands of lenders to receive the best quote. Online lending marketplaces try to solve this but fail because:

- It’s difficult for lenders to underwrite automatically, so they often give price estimates rather than firm offers

- It’s been difficult to convince capital providers to aggregate on a single marketplace controlled by someone else.

DeFi solves these problems of coordination and access. A decentralized, shared public ledger enables developers and capital providers to all participate in the same marketplace and make decisions on verifiable data instantly. This enables them to compete on underwriting and price, which is almost always a win for customers.

P2P Marketplace & Reduction of Middlemen Fees

Software that connects borrowers and lenders directly removes the power of gatekeepers and improves pricing for both lenders and borrowers.

Contracts Enforced by Code

Today, monitoring of loan agreements (including capital commitments and covenants) is mostly based on trust, PDFs, and the threat of legal action. By contrast, smart contracts can automatically execute the loan agreement. Again, this is fast, scalable, secure, and ultimately leads to lower costs.

Self-Custody of Assets and Data

Self-custody is impractical in closed loop systems. Having a paper stock certificate in a vault or a digital stock certificate on my hard drive is difficult to trade or sell. In crypto, users have the choice to self-custody to reduce counterparty risk without trade-offs. This applies to both crypto assets and data. Compare this to the current banking system, where third parties control access.

It’s clear that the mechanisms of traditional lending are wasting time, putting many people at risk, and locking people out of the system. The opportunity to change this – combined with the explosion of developer creativity and competition – could have a game-changing impact on the lending market.

So, how do we build this better system?

What Will Bring DeFi Lending to the Mainstream?

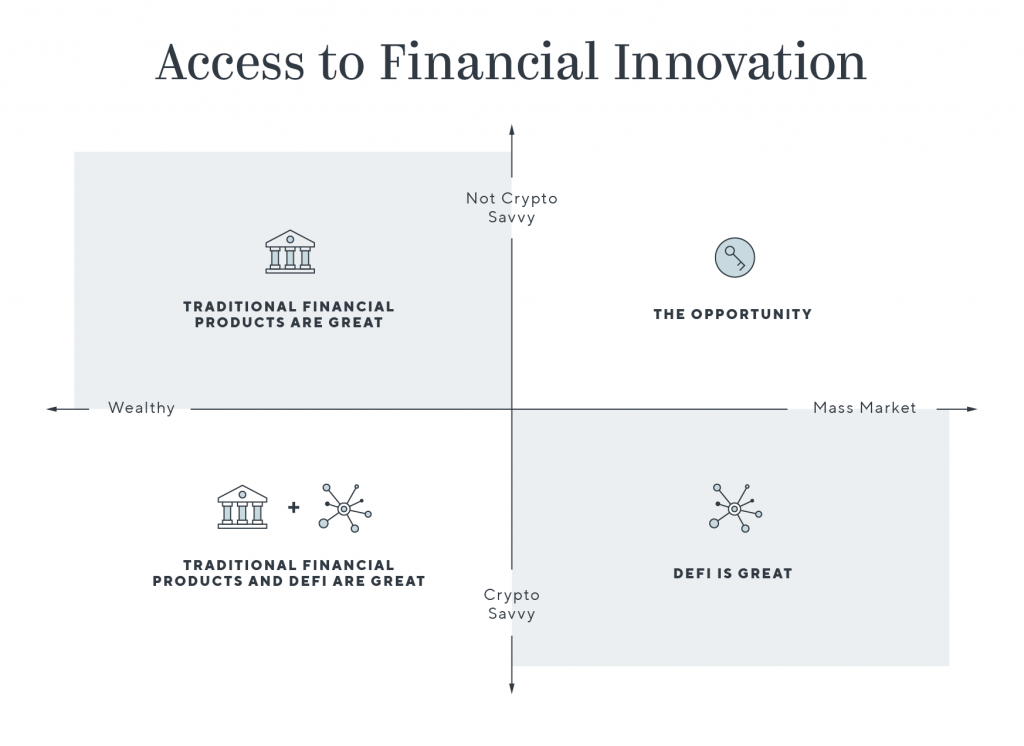

DeFi lending is useful – at least in theory. But today it’s both niche and underdeveloped.

The main blocker today is that if someone wants a DeFi loan, they need crypto assets. That means DeFi lending is only useful for crypto early adopters. As a regular person, there’s no option to use non-crypto assets as collateral, or to tie one’s identity to a wallet address to borrow based on their reputation. There’s also no marketplace to match borrowers and lenders directly, and there isn’t great infrastructure for scalability and privacy.

I see five areas that are essential to build in order to break DeFi lending out of the niche of early crypto adopters and into an open system for everyone:

- Representation of off-chain assets on-chain

- Enablement of identity and credit linked to wallet addresses

- Creation of a marketplace of borrowers, lenders and underwriters

- Underlying scalability and privacy infrastructure

- Regulatory clarity

Each of these areas are ripe with opportunities for new applications and companies to drive the next crypto wave.

Let’s look at each.

Representing off-chain assets on-chain

How to Tokenize Non-Crypto Assets

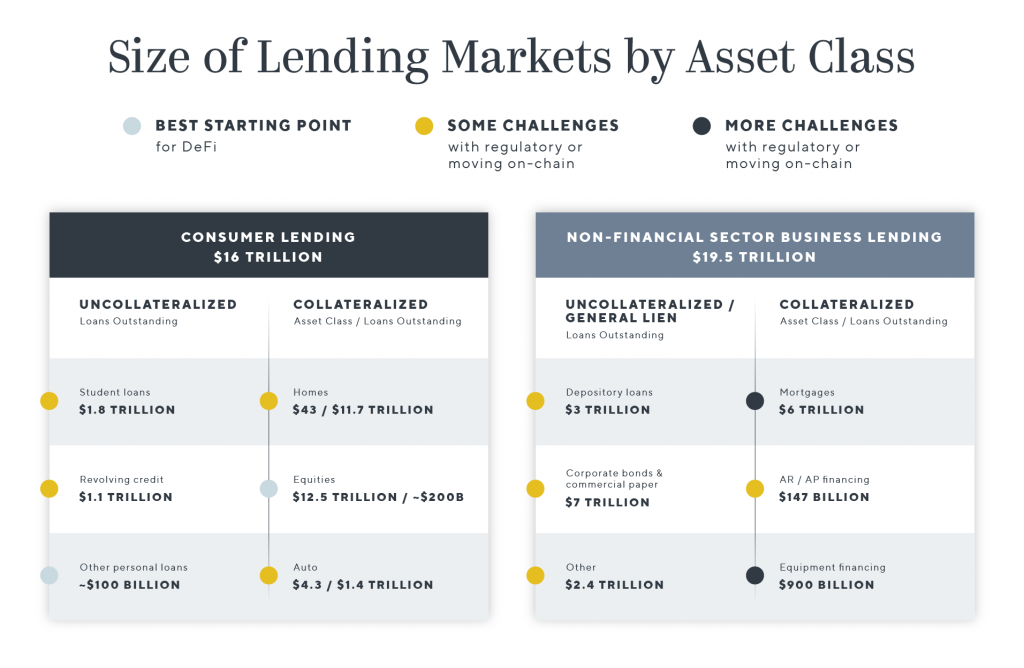

Today, if I have non-crypto assets that I don’t want to sell (e.g. stocks, bonds, houses, cars, and jewelry), I’m locked out of DeFi lending. We need infrastructure linking the existing financial world with the liquid capital markets and developer innovation in crypto. Which asset class is the best starting point?

There’s roughly $20 trillion of secured loans in the U.S. across consumers and businesses. There are three factors to consider to determine which assets to bring on-chain first. We could optimize for:

- Least regulatory burden: Accounts receivable and accounts payable (AR/AP) factoring for small businesses makes up $147 billion of lending volume in the U.S. and does not require a lending license. However, there’s no digital source of truth or consistency on these contracts, which makes them difficult to move on-chain. As an example, MakerDAO recently partnered with Huntington Valley Bank (HVB) to fund a basket of business loans originated by HVB.

- Greatest consumer benefit: Tokenizing illiquid assets can unlock significant value, but it’s difficult for both regulatory reasons (you need to be an accredited investor) and operational reasons (standardizing value and accessing real-time price feeds). Companies like Goldman Sachs are starting to explore tokenizing illiquid assets.

- Quickest go to market: Tokenizing liquid assets, like public equities, is easier to execute as it does not require accredited investors, has real time price feeds, and standardized securities that are already custodied digitally. It’s a $12.5 trillion asset class in the US with $200 billion of lending volume. The downside is that the benefit of tokenization is more incremental, and there are still regulatory hurdles related to issuing and trading securities. Centralized exchanges have offered “tokenized” synthetic equities in the past, but they were limited to being bought and sold within those exchanges, and therefore weren’t useful for DeFi.

I will start with #3, public equities, as I believe it’s the fastest path to delivering real value to people.

How it Would Work: “Circle for Equities”

Here’s how public equities could be represented on-chain.

Circle has already done this for payments by representing the U.S. dollar on-chain. On-chain dollars solves the volatility of crypto assets while maintaining the benefits of an open and global payment system. Even during the current “crypto winter”, stablecoin volume is over $500 billion per month. Perhaps down the road, assets will live natively on-chain. Until then, we need infrastructure to connect the two worlds.

Here’s how Circle works: I give Circle $1, they custody that $1 in US treasuries, and they issue 1 USDC to my wallet address. When I’m done, I (or anyone who’s received USDC) goes back to Circle, and exchanges 1 USDC for 1 USD. In the interim, Circle is happy because they’ve earned a ~4% yield on the dollars I deposited as they’ve invested them in US treasuries, and I’m happy because I was able to send and receive value more easily than if I held cash.

Similarly, a NewCo. could custody my 100 shares of Microsoft, and issue me 100 MSFT-D tokens that are each redeemable for one share of MSFT. Then, I could stake these shares as collateral for a loan in a DeFi protocol, which capital providers could compete to fund instantly. This NewCo. would need to do several things: deal with the regulatory nuances of issuing digital shares, manage KYC for on-ramps and off-ramps, and also maintain a blacklist of wallet addresses that could not receive tokenized equities. Everything else would happen on-chain by market makers and developers. The custodian could monetize transaction fees on-chain and monetize custodied equities off-chain.

The Value of Tokenizing Equities

A key question is, why would I want to tokenize my equities?

Today, a trader/investor is limited to the software innovation of the back office of their brokerage. With tokenized equities, investors break out of this mini-monopoly and enter a public ledger where developers can build products that help them manage risk and increase wealth. Specifically, this can include (1) competitive/low cost margin lending (2) instant settlement to high-yield stablecoins (vs. 3-day settlement & no yield on cash) (3) software tools that can intelligently and instantly manage risk via hedging strategies and (4) access to a global, 24/7 marketplace.

Enabling Identity and Linking Credit to Wallet Addresses

Control over data; access to cheaper loans

The next mainstream category for DeFi lending to tackle is unsecured personal loans, a ~$100B lending market in the US if you exclude credit cards and student loans.

Again, assuming data is available on chain, the key benefits of crypto rails include:

- The ability to instantly verify data and monitor in real-time, regardless of its source.

- The ability for millions of algorithms to compete for the best underwriting method.

- The enablement of complete user control over data.

However, because of limited on-chain data, the current state of DeFi lending is pooled vaults where borrowers and lenders get the same terms pre-defined by the protocols. This is because there’s no way to check the “credit score” of a wallet address, so the default is to treat everyone as if they’re bad actors, which leads to higher prices and collateral requirements. This is inefficient.

To enable unsecured personal loans on-chain, we need to build tooling that allows individuals to link their real world identity, credit scores, assets, and income to their wallet address in a privacy-preserving way. While doing this, we need to solve for an over-reliance on a single trusted source. And, it will be important to solve for identity permanence. For example, if you default on a loan in DeFi, and then create a new wallet address, do you erase your bad behavior? Or, is it recorded back to the “off-chain” credit bureaus, or otherwise traceable on-chain? If there’s no identity permanence, credit will be more expensive. Individuals should have the choice if they want to “permanently” tie their identity to a loan to get a cheaper rate, or not.

Some companies building in this space are Spectral (on-chain credit scoring), APIs for off-chain user data including Privy, Burrata, Jomo, Astra, Quadrata, Sealance, and Polygon ID and on-chain risk management systems like Carapace.

When these companies gain adoption, individuals and businesses will be able to disclose financial data on-chain using zero-knowledge proofs, which are a mathematical technique that allows someone to verify that something is true without seeing the underlying data.

For example, it will be possible for lenders to cryptographically verify that I am an American citizen that makes over $x with over 750 FICO score without actually revealing my salary or linking back to my identity. Then, with these proofs available on chain, millions of bots, underwriters and capital providers can analyze the data and compete to fund borrowers.

The beauty of this system is that individuals have control over how much data they disclose, compared to the status quo where gatekeepers decide the rules. If a wallet address wants to remain anonymous and disclose no data, they simply pay more (more collateral, higher prices). If an individual wants to selectively disclose more data (income, assets, bank statements etc.), they pay less.

The status quo of unsecured lending involves people disclosing too much data and lenders analyzing too little data. Crypto unlocks both user control and developer access to larger data sets. This will increase access to capital for more people while preserving privacy.

A Marketplace of Borrowers, Lenders, and Underwriters

Driving developer creativity and competition

Once we have tokenized equities and linked identity to wallet addresses, we need a decentralized marketplace to match borrowers, lenders, and apps. The status quo of DeFi lending are pooled vaults with fixed terms. The future is an automated marketplace.

Similar to how Uniswap created an AMM for decentralized trading, we need a decentralized order book for lending. Some early players in this space include Lulo and Morpho. Early attempts at order books for lending have failed because of liquidity.

One solution is exemplified in a product called “Matcha”, created by Greylock portfolio company Ox. Matcha is an aggregator of decentralized exchanges that helps users and developers find the best price for a trade. Similarly, one could build an aggregator of lending protocols that attempts to match borrowers/lenders directly, but otherwise defaults to the best rate available among existing protocols.

Building Underlying Scalability and Privacy Infrastructure

Shifting consumer lending to crypto rails requires underlying infrastructure that is low-fee, high-throughput, and enables transactional privacy with compliance. The status quo of networks like Ethereum are high cost and built on public ledgers where one can see every transaction linked to a wallet address. This isn’t practical for consumer lending at scale. Exciting projects in this space include our portfolio companies Espresso and Chia, and projects like zkSync, Aleo, Aztec, Aptos and Mysten.

Regulatory Clarity

Finally, we need regulatory clarity on how to interact with tokens that are considered securities. We need a regulatory framework that protects consumers and investors while also enabling innovation in this new system. The primary questions include what is considered a security, how are securities handled, what is considered a lender, how are they licensed, and how are gains/losses taxed.

In the meantime, there are examples of more conservative approaches in DeFi like “permissioned trading pools” like Aave Arc that ensure regulatory compliance. Regulatory clarity will be one of the key catalysts for the next crypto summer, and bringing the magic of crypto mainstream.

Conclusion

It’s hard to overstate the impact of an instant, global, and open financial system. To put it in perspective, consider a similar scenario from the ‘90s, when news organizations began putting news online. If you were trying to describe the benefits of digital news compared to print, you might list things like instant availability, lower costs to publish, and the open read/write system that removes many gatekeepers. But someone reading an article on nyt.com instead of the physical New York Times wouldn’t viscerally understand the true potential of the infrastructure that enabled digital news – i.e., the internet – until they experience digitally native platforms like Twitter (notwithstanding current drama).

Likewise, DeFi lending unlocks an instant, open, and creator/developer-led system – but this time for value, not information.

Making DeFi mainstream is about much more than providing faster, cheaper “digital” loans, and the system would affect more than just the $16 trillion consumer lending market in the U.S. Outside of this country, very few people have access to credit, meaning it’s hard or impossible to buy a phone, car, house, or business unless you have cash. If you have a system to quickly and affordably exchange and verify assets and income using code, it becomes possible to serve more people and help them enter the modern financial system.

I’ve laid out a roadmap of the infrastructure needed to make Defi lending mainstream. We can apply this same framework to other crypto use cases such as payments, gaming and collectibles. The result will be a system that is far more accessible and intelligent than what we have today. While tourists shift focus to the next hot space, builders will unlock the next trillion dollars of programmable money.