Throughout every new era of technology, investors have always been eager to back the so-called “picks and shovels” of the moment. Today, we see this in the valuations of NVIDIA and foundational models.

But, while others rush to back the enablers, someone still needs to find gold. I want to back founders who are willing to take the risk to build enduring, AI-enabled products that will change how people work and live.

I believe there’s tremendous value to be captured by product builders who can successfully put the power of AI into products that people love. As my partner Jerry Chen recently put forth, if we’re living in an age where foundation models make it possible for anyone to build an AI company, “the most strategic advantage [of applications] is that you can coexist with several systems of record and collect all the data that passes through your product.”

This is already happening with founders like Keith Peiris and Henri Liriani from Tome, or Cristóbal Valenzuela from Runway. They aren’t just using AI to enhance a product – they are using AI as the key unlock to drive their entire product development and business strategy.

Of course there are plenty of detractors who don’t believe startups have a chance at this layer – incumbents own the data and distribution, and access to LLMs is both commoditized and fraught with platform risk. There will likely be many casualties of companies where an API call to OpenAI isn’t sufficient to build lasting value.

In this post, I present my thesis for the next wave of AI-first products and outline a few ways founders might approach this opportunity.

As I see it, these are the three largest opportunities for founders to build AI-first companies:

- AI-first networks & marketplaces

- Re-defining enterprise software categories

- Co-pilot for services

AI-first Networks & Marketplaces

In the last wave of consumer software, social networks and marketplaces were the dominant business models that created trillions of dollars of market cap, with Meta alone valued at just under $800 billion. Greylock was lucky to back many of these, including Meta, LinkedIn, Roblox, Airbnb, Discord, Musical.ly (now TikTok), and Nextdoor.

As reflected by the valuations, these networks were assumed to be “unbreakable”.

But now, AI challenges many of our initial assumptions. This is creating a new arms race to build the next AI-first network.

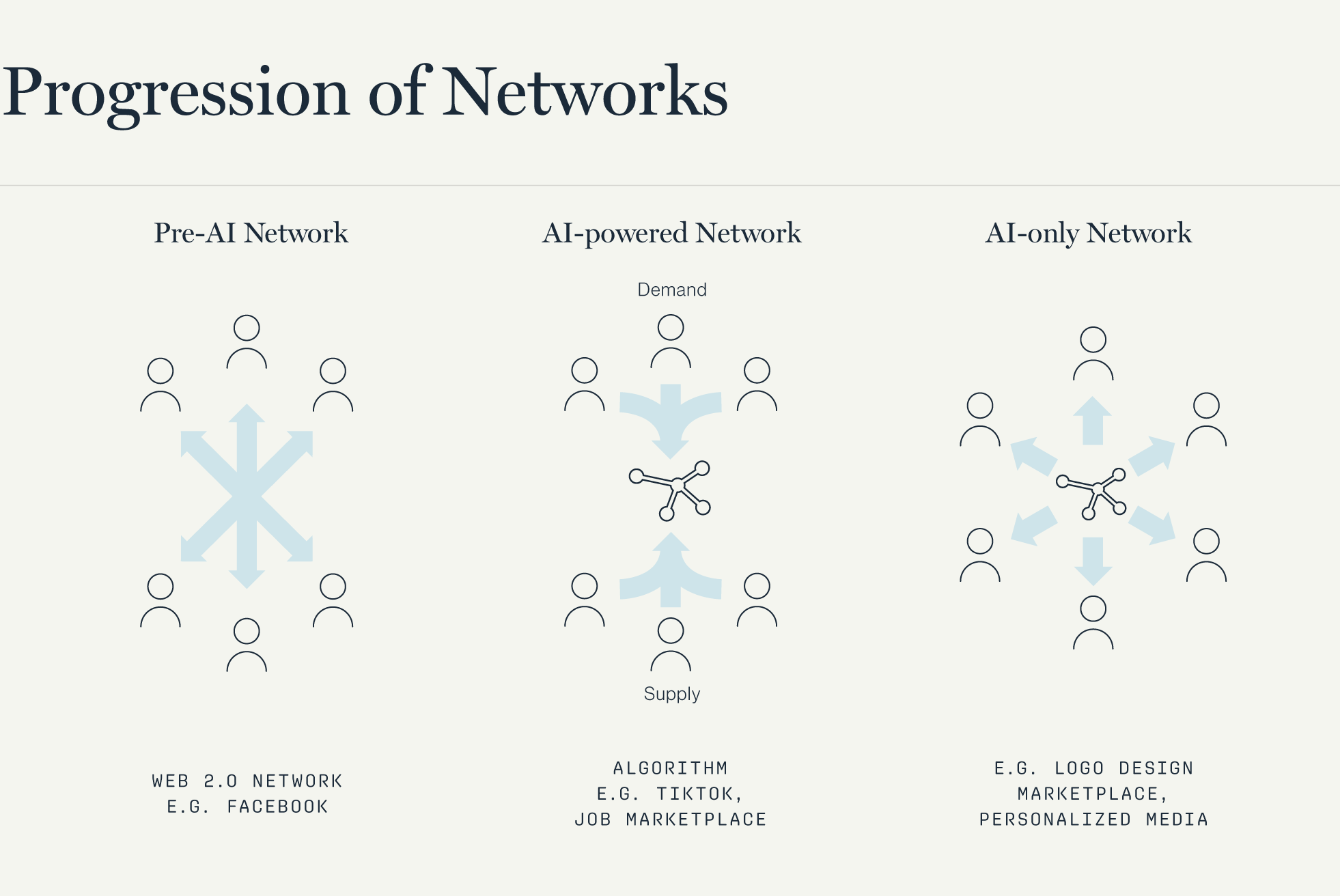

We moved from networks that connect people to algorithms that connect people to content. Now, we’re moving to algorithms that replace people.

The progression, as I see it (and as Sam Lessin eloquently described):

- Pre-AI network → people connected with people and businesses

- AI-powered network → people posting & consuming content for/by the algorithm

- AI-only network → AI creating personalized content for each person

Beyond social networks, AI will impact a range of “bits only” networks including dating apps, gaming, labor marketplaces, and specialized skill marketplaces. Most incumbents will incorporate AI in some form, while others will overhaul their entire product to be AI-first. Most likely, incumbents will be slow to move, and entire categories will be up for grabs.

As founders evaluate AI-first marketplace opportunities, I’d consider two things:

- Marketplaces that generate unique data from participants

- Marketplaces that connect two sides, rather than replace one

To illustrate the point, let’s take two marketplaces that will be rebuilt using AI and compare them on these dimensions: a freelance logo design marketplace and a jobs marketplace.

You can imagine a freelance logo design marketplace, like parts of Fiverr, will be replaced with an algorithm. A user inputs a prompt, and after a few tries, gets their logo. In this case, the data the algorithm receives is fairly shallow (prompts and selection), and the supply side is entirely replaced by an algorithm.

Contrast this to an AI-first jobs marketplace. The optimal product would be an AI career coach for job seekers and an AI assistant for recruiters – two seemingly separate products, connected by the same algorithm. The coach could gather deep insight from a job seeker – far beyond what they would share on a resume or LinkedIn – and use this data to not just find the perfect match, but help them discover their most fulfilling career path. Combine this data with a strong understanding of a recruiter’s needs, and both the coach and assistant get better.

In this case, the product is designed to gather more nuanced data, and the AI is augmenting and connecting both supply (job seekers) and demand (recruiters) rather than replacing one.

Many marketplaces will be re-built with AI – either by start-ups or incumbents that are willing to blow up their product or business model. As you’d expect, I’m betting on the start-ups.”

Re-defining enterprise software categories

Platform shifts are often significant enough that it creates a window to re-build large categories of software. Take productivity and the shift to the cloud. Despite Microsoft’s dominant position with Microsoft Office (and their complementary dominant position in the cloud with Microsoft Azure) they left a $50bn+ hole in the market for collaborative software that products like GSuite and Figma captured. For many use cases, the only feature that mattered was real-time collaboration, which allowed GSheets to capture market share despite having fewer features than Microsoft Excel.

Similarly, there will now be many software categories where the dominant feature is AI, which gives new entrants enough runway to reach feature parity before incumbents catch up on AI.

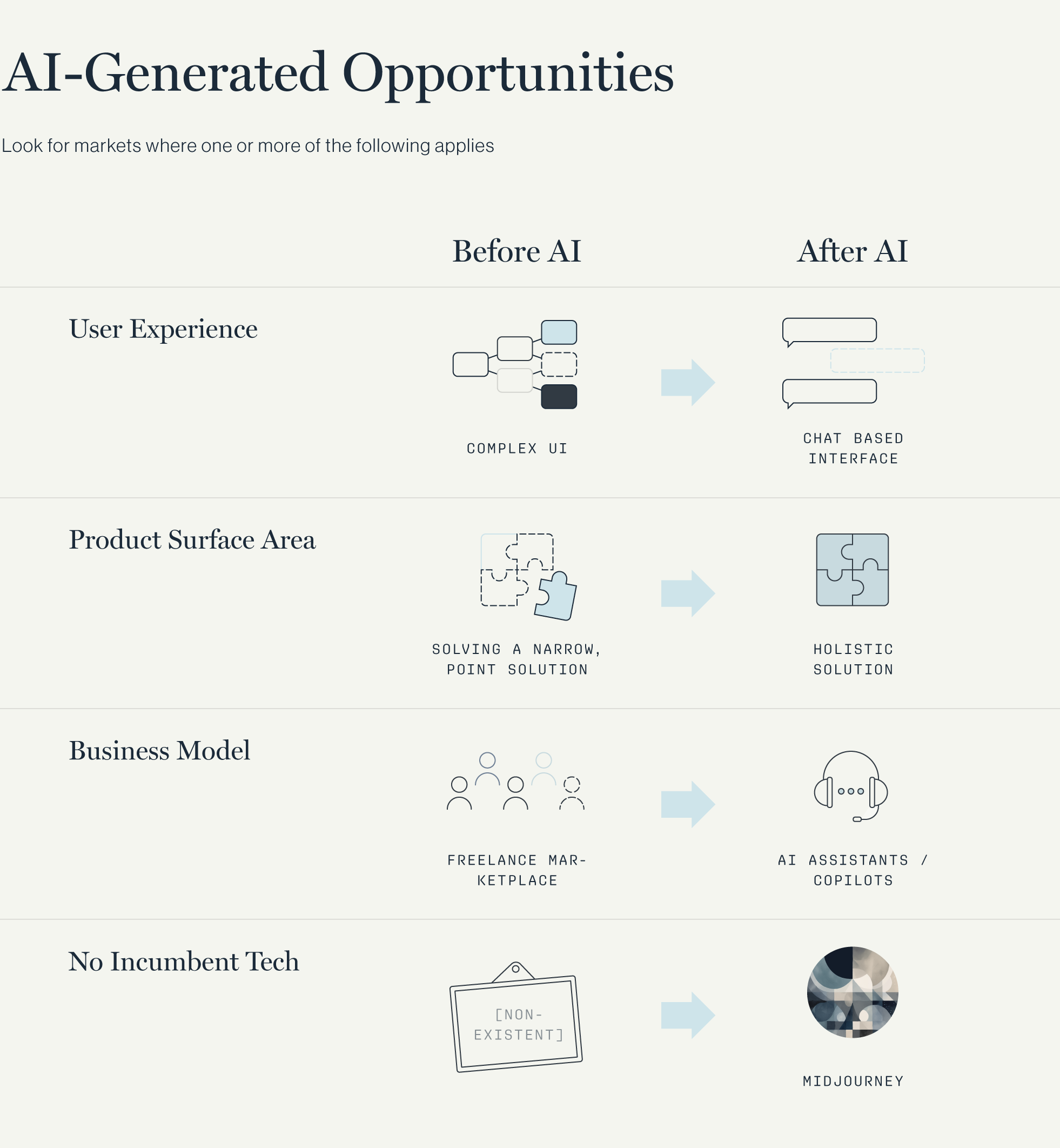

The best opportunities for start-ups attacking large software categories comes from finding angles where incumbents can’t compete. Here are four examples:

- UI/UX is re-imagined with AI – incumbent UI is irrelevant

- Product surface area is re-imagined with AI – incumbents compete at a different scope

- Business model is re-imagined with AI – incumbent business model can’t adapt

- No incumbent tech co before AI

Take productivity as an example. Companies like Tome, an AI powered presentation tool backed by Greylock, want to solve the end-to-end workflow of a knowledge worker: from idea to gathering necessary data, to presenting a coherent argument. Today, PowerPoint only touches the last part of this process, enabling Tome to compete on a different axis.

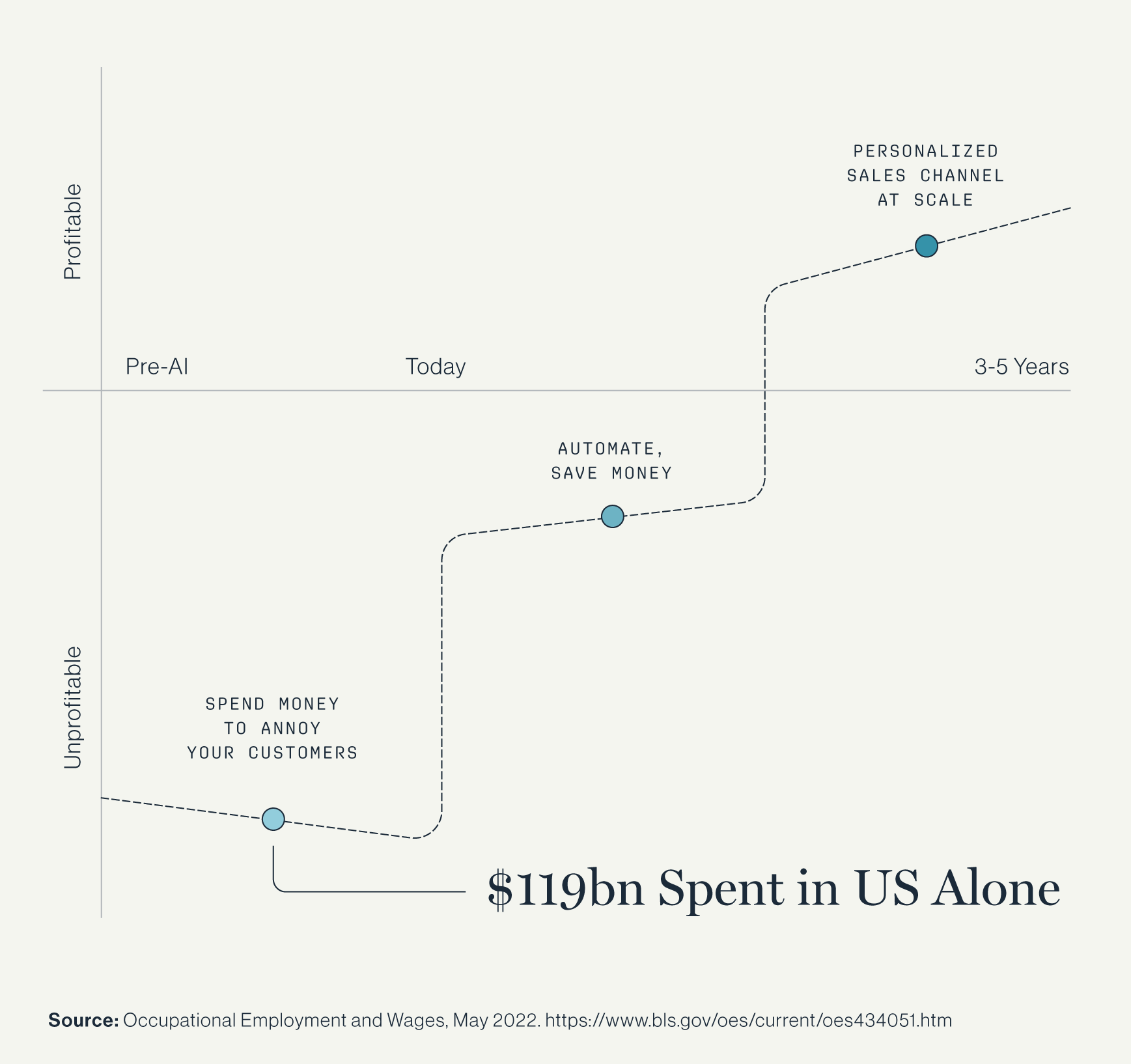

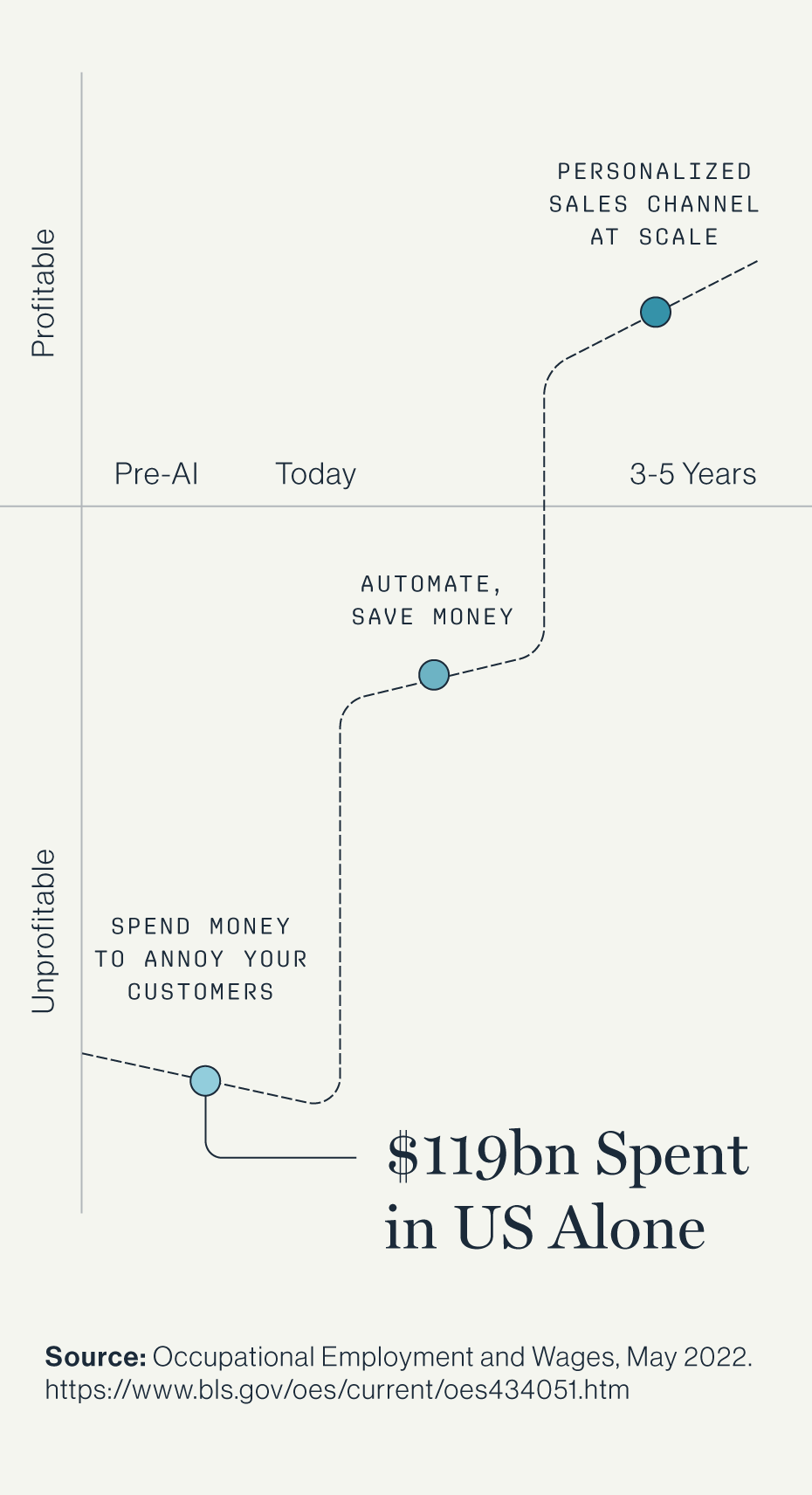

Another great example is customer service, a $10 billion software category. The “obvious” starting point would be to automate customer service reps using AI. But what if the entire concept of customer service was re-imagined? Today, most companies actively reduce call volume by hiding the “contact us” button behind 5 menus and an ever-expanding phone tree. But, in a world of AI, every interaction can be cheap, delightful, and revenue-generating. In that world, companies might actively try to speak with their customers.

When I was at Meta in 2016, we tried to remedy this with an AI bot platform. Piloting with KLM airlines, we built an experience where Messenger handled every aspect of the passenger’s journey – boarding pass, customer service, travel recommendations at their destination, etc, all in a single conversation.. Despite amazing feedback, this pilot was shut down because of the cost to serve – but today, LLMs could make these types of interactions possible.

Greylock portfolio companies including Cresta, Postscript, Gladly, and Curated are all working on different angles to this problem of re-thinking how businesses use AI to communicate with their customers.

Rather than being intimidated by the data and distribution advantage of incumbents, I encourage founders to find angles where incumbents are not competing at all.”

Co-pilot for services

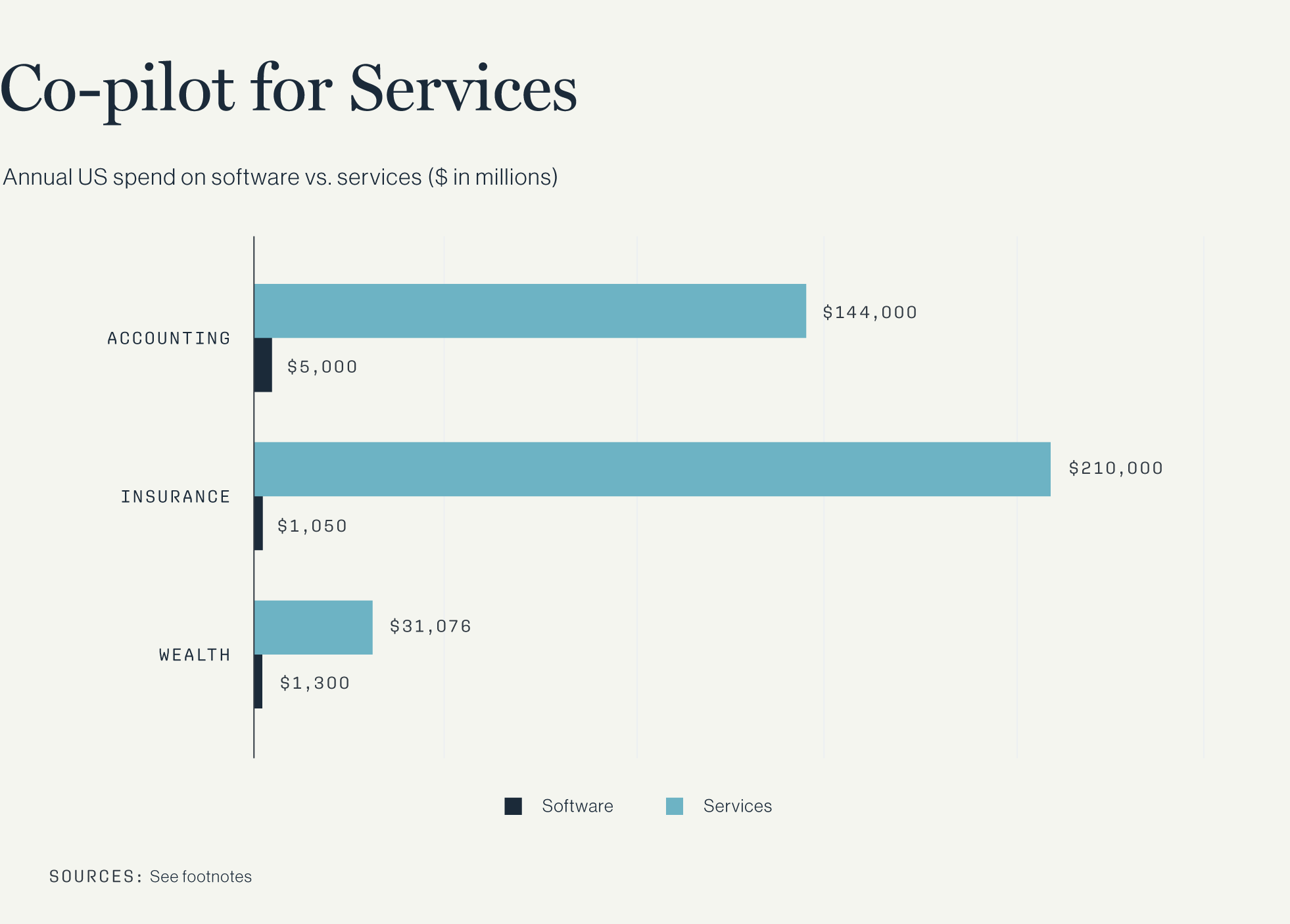

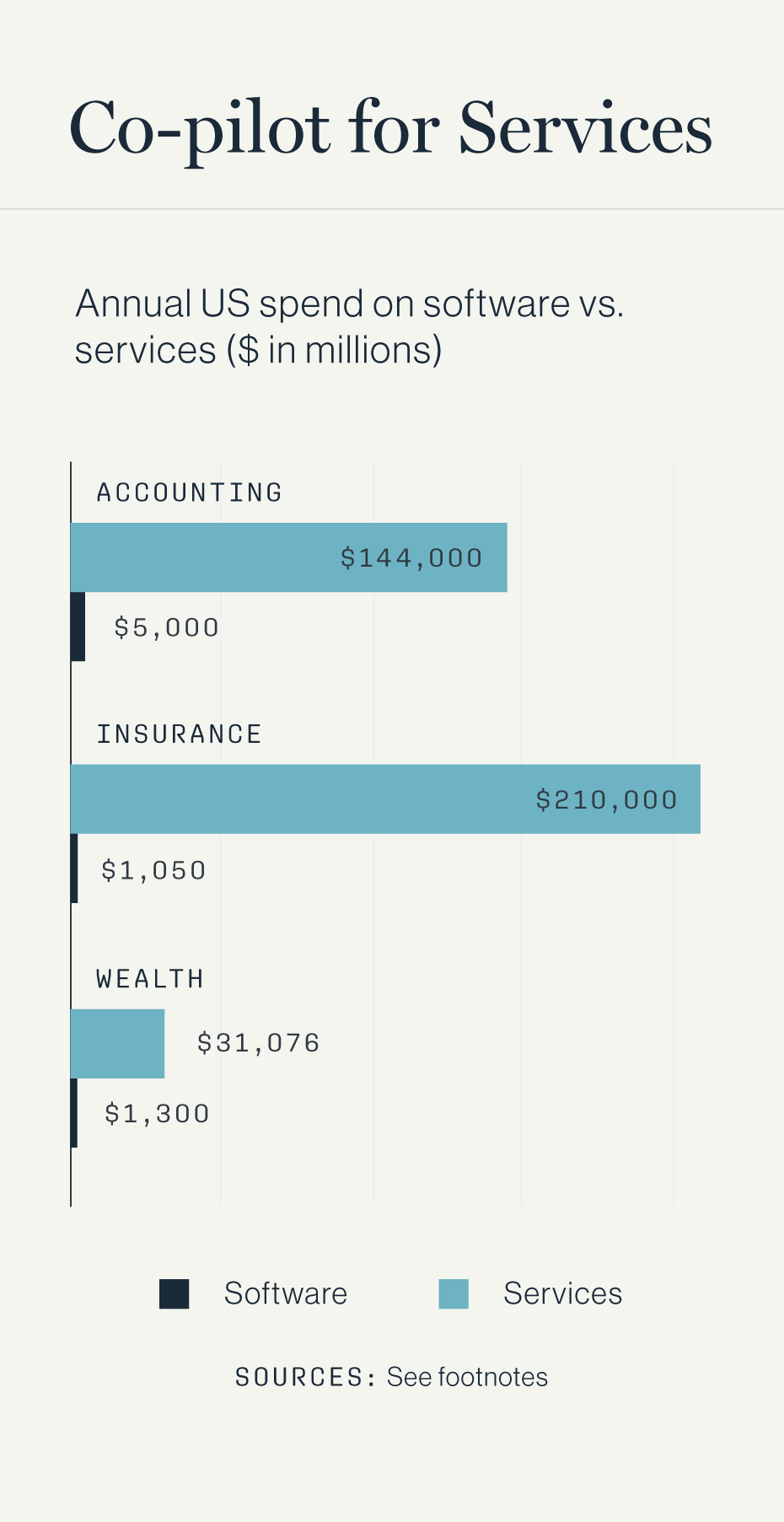

One of the most interesting new opportunities with AI is going after the vastly larger market for services versus software with AI “co-pilots”. Most knowledge work involves analyzing and transforming data, a task that algorithms are better suited for.

I believe the best opportunities for co-pilots are “branded” sales people, like wealth managers, insurance brokers, and mortgage brokers. Their role involves a lot of text- based coordination, they work across multiple apps, and the ROI of increased efficiency is tangible. Take wealth managers as an example. According to Morgan Stanley, the biggest indicator of client retention for wealth managers is not portfolio performance, but consistency of personalized interactions with clients.

If an AI-based agent could combine information from a client’s portfolio, the individual firm’s equity research, and the firm’s CRM — all trained on an individual’s unique tone – a wealth manager could send personalized notes to clients every week by simply pressing a button. In the end, if a wealth manager can deliver personalized service to 1,000 clients instead of 100, everyone is better off.

While co-pilots are perhaps over-hyped by some, the opportunity is significant – enabling software companies to go after spend for services, not just software, opens up markets measured in the 100s of billions.

Summary

There’s lots of noise in AI. From true techno optimists who envision AI as the great amplifier of humans, to pessimists who see every app as just a thin layer on top of OpenAI, to the optimists-turned-pessimists who believe AI will automate all jobs (and take over humanity).

Undoubtedly, there will be detractors who believe many products are simply features on top of foundational models. But builders who see AI as the driving force behind product development and GTM strategy will actually create new markets and experiences that never existed before.

By combining expertise in products and domains with a fundamental understanding of human behavior and AI, these builders will bring defensible, valuable AI-first products to life.

I view AI as an important generational technology wave – just like the internet, mobile, and cloud. It’s an opportunity for the most ambitious entrepreneurs to build new things that change how we work and live. As I’ve outlined, this could be AI-first networks such as labor marketplaces; products where AI unlocks a new category of software entirely; or AI that enables co-pilots in industries including financial services. If you are a founder who shares this vision, please get in touch with me.

“Co-Pilot for Services” Sources:

Accounting software (assume 30% global is US): https://www.mordorintelligence.com/industry-reports/accounting-software-market/market-size

Accounting services: https://www.ibisworld.com/industry-statistics/market-size/accounting-services-united-states/

Insurance software (assume 30% US): https://www.einnews.com/pr_news/626672027/insurance-software-market-size-us-5-1-billion-global-industry-report-2023-2028

Insurance services: https://www.ibisworld.com/united-states/market-research-reports/insurance-brokers-agencies-industry/

Wealth software: https://www.grandviewresearch.com/industry-analysis/wealth-management-software-market

Wealth services: https://www.financestrategists.com/financial-advisor/advisor-types/how-many-financial-advisors-are-in-the-us/#:~:text=According%20to%20the%20latest%20U.S.,advisors%20employed%20in%20the%20country