The cloud has created thousands of opportunities for new businesses and business models by reducing the cost to start a new company and experiment with different ideas, leverage machine learning, and transform nearly every facet of our lives.

Listen to this article >

Listen to this article >

As a result, the rise of cloud has most notably given rise in the US to three dominant cloud vendors upon whose services virtually everyone relies — Amazon Web Services, Microsoft Azure and Google Cloud.

The Big Three ‘Cloud Castles’

Over the past fifteen years since the launch of AWS in 2006, the Big 3 have each built up moats of defensibility that essentially guarantee their status for the foreseeable future: massive economies of scale combined with strong network effects and easy distribution of new services to users.

Fortified with these moats, the Big 3 have near-infinite resources and unparalleled control of distribution. They have a direct relationship to the developers, combined with a low marginal cost to launch and promote new cloud services.

These “Cloud Castles” have each been able to spin up hundreds of different developer services, from security and storage to DevOps and artificial intelligence tools, and cloud growth has been fueled even further by the pandemic-induced acceleration of cloud adoption.

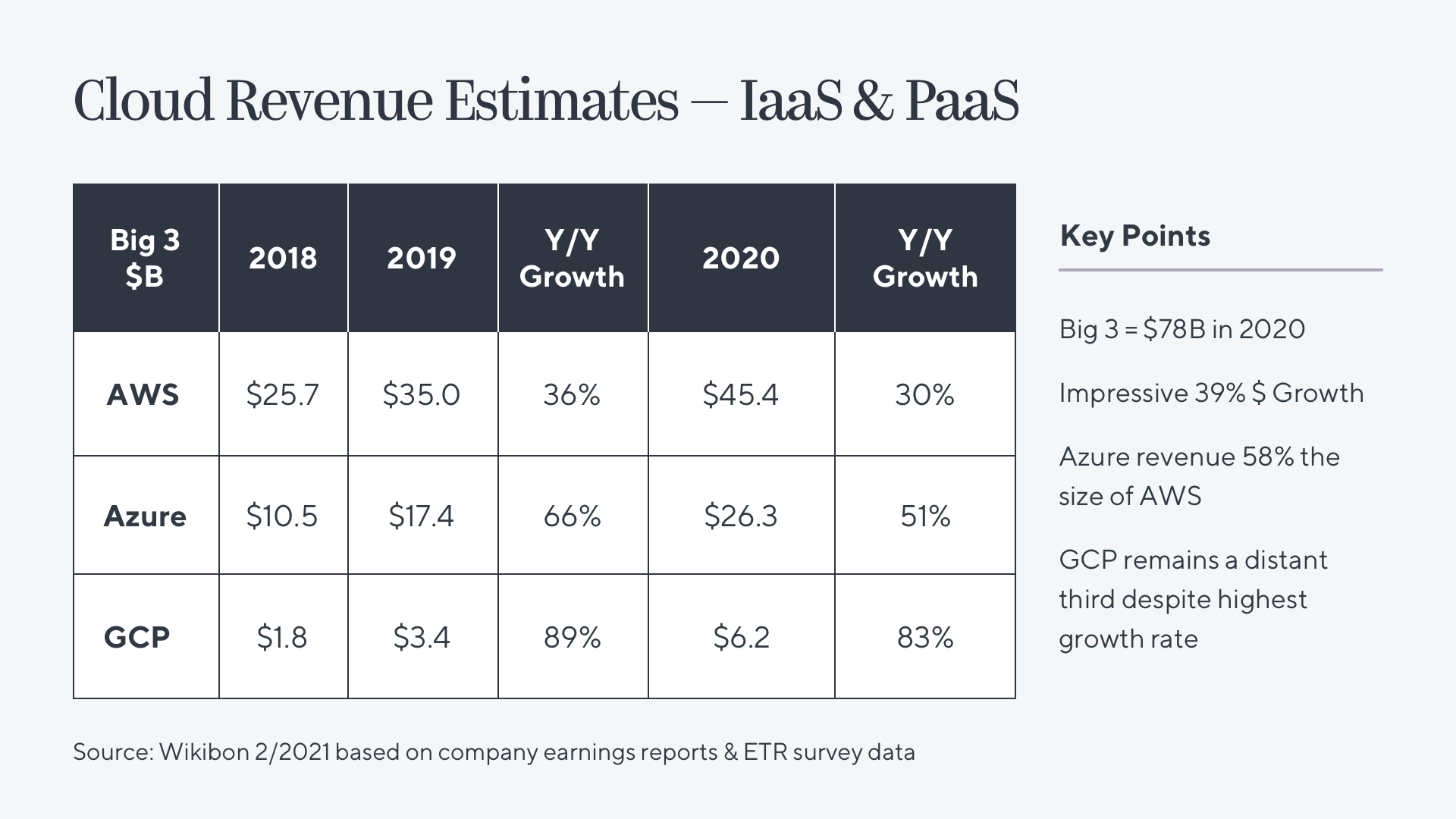

In 2020 alone, AWS, Azure and Google Cloud saw their revenue increase 30%, 50%, and 80% respectfully.

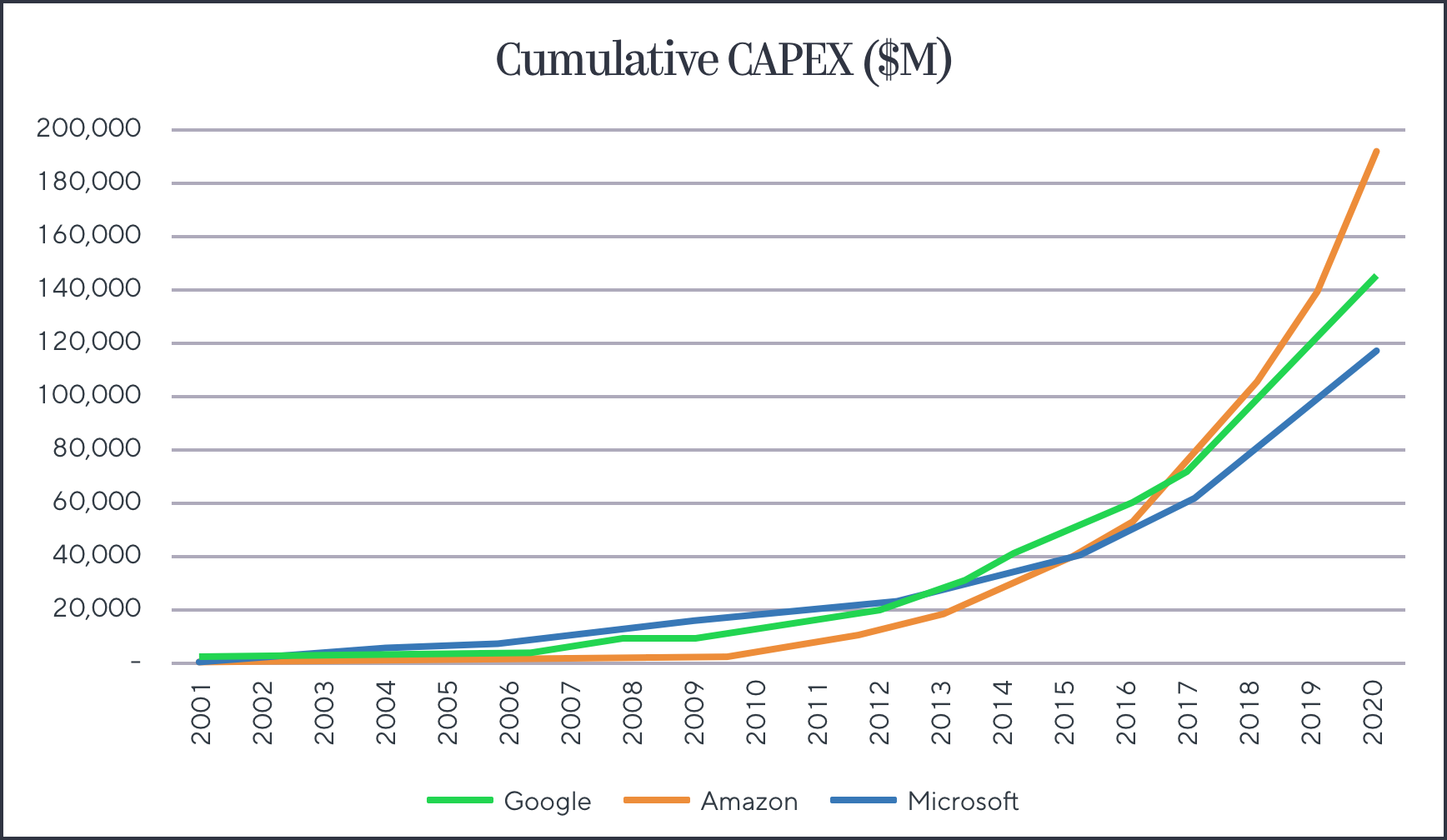

Source: https://www.platformonomics.com/2021/02/follow-the-capex-cloud-table-stakes-2020-retrospective/

And yet, it is not game over for everyone else.

Opportunities on the Ground

We know that the most intense head-to-head competition AWS, Microsoft, and Google face is from one another. As such, there is almost no point in trying to become the fourth monolith, (although Oracle Cloud and others are trying). But as I first postulated a few years ago in an essay on The New Moats, there are many ways to build businesses in the shadow of the cloud castles.

Following that post, I had several conversations with founders, executives, and investors about different ways to take on the Big 3 by creating businesses that compete directly with one or more of their individual offerings.

Source: https://twitter.com/dvellante/status/1357000398800887809?s=20

As I later put forth in my essay on the Evolution of Cloud, that movement is well underway.

The 2020 and 2021 IPOs of several cloud companies like Snowflake ($SNOW), Confluent ($CFLT), Hashicorp (IPO 2021 or 2022?), and Databricks (IPO 2021 or 2022?) have demonstrated that the sector is large and dynamic enough for others to successfully coexist alongside the Big 3.

Meanwhile, the growing demand for tools from companies like Chronosphere, Rockset and Cato Networks illustrates our shift past the cloud transition era and into the cloud-only era.

A New Way to ‘Rule’

Numerous opportunities still exist to push the boundaries of what the technology can accomplish.

This is why we’ve begun a new undertaking at Greylock: a comprehensive, interactive project to map the cloud ecosystem.

First, we are compiling and categorizing the various independent cloud services offered by AWS, Azure and GCP. Enumerating which services are provided by which cloud vendors gives us a snapshot into where the Big 3 are investing and potentially how they are different. This look will try to answer some basic questions like, “Which cloud has more ML services? Which clouds provide a platform for IOT?” and other areas for comparison.

The second effort we are launching and asking for help from the community is to enumerate companies and startups who are competing against these individual cloud services. This database started by us and hopefully augmented by other founders, executives, and investors will help us create a living tactical guide to understanding:

- Where the cloud incumbents are investing their resources;

- Where startups are succeeding competing against the cloud vendors;

- How startups are able to cross Big Cloud’s proverbial moats;

- Where should we expect the next wave of innovation/investment? Why?

Over the next few months, our primary aim is to identify which strategies are allowing challengers to win in their sector, and why they are able to do so at this point in time.

The project reflects the cloud ecosystem in 2019 and 2020. We will update this database annually at the close of each year. In Q1 2022, we will populate this data table with updates from 2021.

To compare the cloud services in context of the startup environment, we ran PitchBook queries on private software companies that reached a valuation of $500m+ in 2019 or 2020. We categorized these companies against the markets and submarkets in which their product offerings compete against the cloud providers’ services. We then supplemented this data with select early-stage startups (valued under $500M) we’ve seen competing in these markets.

To learn more about our process, check out our essay on the methodology behind the project on our Castles in the Cloud website at www.greylock.com/castles. To learn what we’ve found so far, check out Corinne Riley’s essay on the top trends from the funding data, or listen to our podcasts on Greymatter.

As we analyze the data, we will continue to publish essays on the Greymatter blog examining how and why it is possible to compete with the Big 3 cloud vendors, along with case studies detailing various tactics companies are using. We will also host guests on the Greymatter podcast featuring the founders and top executives of several cloud companies.

We look forward to collaborating with everyone on this project.