The rise of Vertical SaaS in the past decade has demonstrated the power of industry-specific software, producing dozens of winners like Toast, Shopify, Procore, and ServiceTitan.

Yet there are still many markets underserved by Vertical SaaS: foundational industries with intrinsic barriers to technological disruption (e.g. unstructured data, constrained TAMs, slow sale cycles, low annual contract values, and tricky incumbents), and sectors that are either just emerging or undergoing a major transformation (e.g. the electrification of energy.)

But now, two key developments have made it possible to build software that serves these outliers: 1) the rise of artificial intelligence that can tackle unstructured data and 2) the redefinition of Vertical SaaS as Vertical Software.

Starting with the data: In earlier tech eras, Vertical SaaS could only be applied to companies with modern tech stacks (those with clean, structured data in systems of record and databases).

That left out the foundational industries that are primarily dependent on unstructured data (e.g. contracts, records, and multimedia files across text, audio, and images). Now, large language models are equipped to handle workflows with unstructured data, meaning AI can be the missing piece that finally brings technologically-underserved industries into the modern era. The broader magnitude of this paradigm shift cannot be understated: an estimated 80% of the world’s data is unstructured.

Next, we’ve seen vertical-focused startups think outside of traditional SaaS models and instead employ strategies like embedded payments (Toast and Shopify), advertising (as Pepper and Provi have done) and B2B marketplaces (Faire and Novi). Adoption of AI will accelerate this transformation, as expected headcount and seat reductions will drive the need for novel usage-based or outcome-based pricing models.

At Greylock, we believe this convergence of large language models and the embrace of differentiated models creates ideal conditions for founders who want to solve long-standing problems.

While concerns about durability at application layer are warranted, we believe a deep domain-specific focus is a viable wedge to establish defensible moats.

As game-changing as LLMs are, the key to success at scale with any vertical play lies in picking an industry well-suited for the technology, accurately assessing the TAM, building deep product workflows and data, designing the appropriate GTM strategy, and possessing a combination of domain expertise and technological prowess to pull it off.

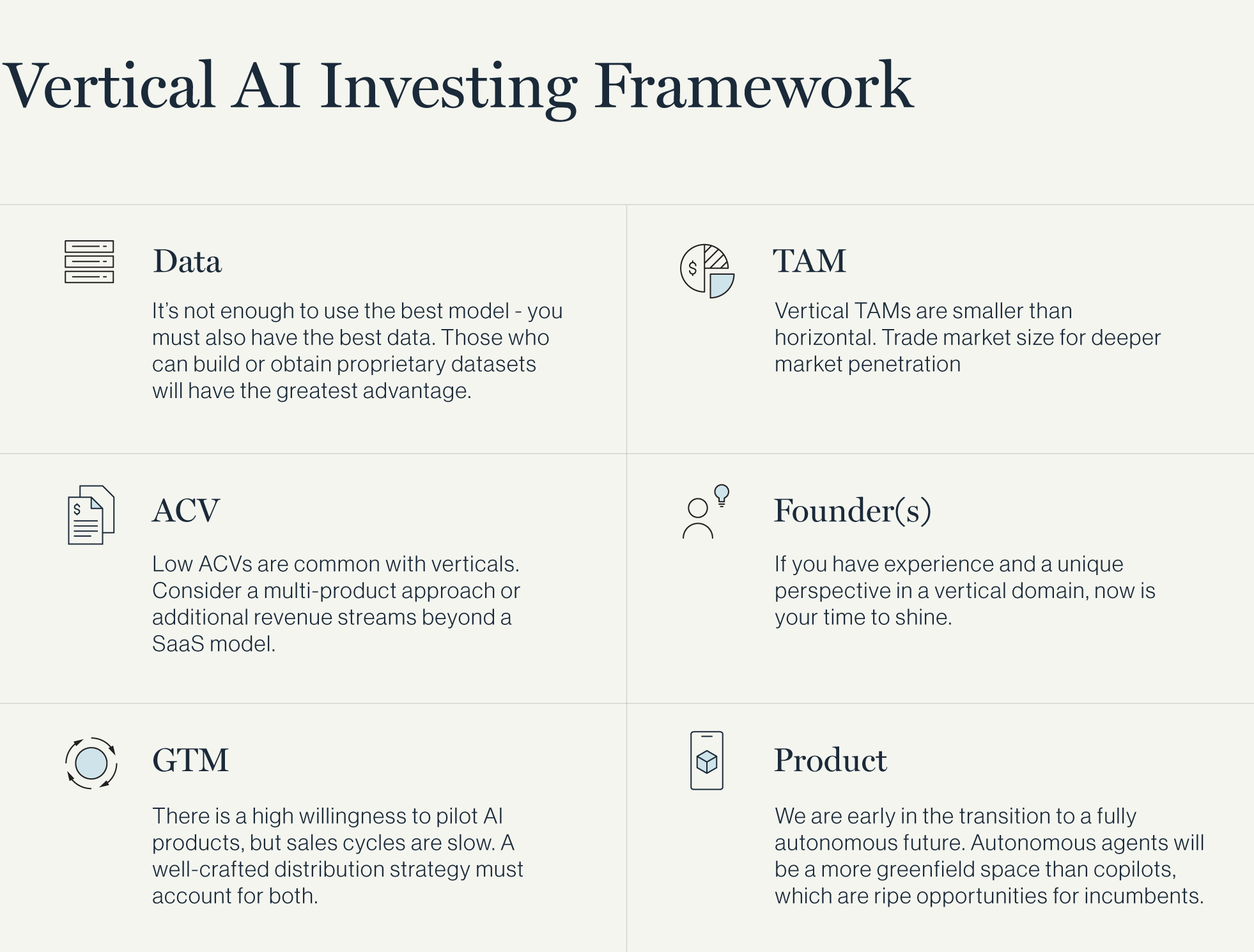

Here, I present a framework for investing in vertical-specific AI.

Let’s dive a bit deeper into each one of those elements.

Data: Better Data Over Better Models

With reduced barriers to building AI applications on LLMs, data is arguably the most important currency in building a differentiated position.

The first step startups must take is to identify whether the vertical or workflow requires a very large corpus of data, or if there is an opportunity to build a proprietary data asset. For some companies, using this data to train or fine-tune your own foundational models may be strategic.

For many verticals, data lives in messy, siloed legacy systems – which is why I’m particularly excited about companies tackling data extraction. It’s a painful and unsolved problem relative to progress on data summarization and generation capabilities. A good differentiator here would be having the best in-class audited, labeled, and continuously updated data.

An even stronger data position would be one where usage of the product itself generates a dataset (e.g. customers labeling their own data or developing a dataset on the interactions with the product itself). Therefore, I would argue that initial access to data is important as the preliminary moat, but ultimately, the data created by customers using your product provides the long term moat.

TAM: Market Size vs Market Penetration

While the biggest risk and reason not to pursue a vertical market is a smaller TAM than horizontal approaches, remember that this can be both a bug and a feature: these smaller markets will have fewer funded competitors, and the narrower focus can allow you to attain advantaged distribution and deeper market concentration.

Given the high degree of fragmentation in many foundational industries like healthcare or financial services, there can be many opportunities within a sector. Plus, the sheer size of these sectors means even a narrower focus can have a sizable market. Again, finding your entry point into a vertical is a matter of identifying which subsectors of the industry are untapped by competitors, have a demonstrated demand for AI, are best-suited for LLM-based tools, and which you personally are best-positioned to provide.

While it’s very difficult to quantify the established spend of markets that are emerging or undergoing a transformation (like the electrification of energy) these are often the markets that spark the most exciting debates among investors. Founders who are early and manage to apply the right vertical software strategy have the potential to define and lead the market.

ACV: Multiple Products and Revenue Streams

A single SaaS product isn’t always the best approach to landing a six-figure ACV. Vertical-focused startups can expand by going multi-product and creating additional revenue streams beyond the core product. Adding new product lines to a core offering allows you to bundle and upsell over time, eventually growing into a sticky position across multiple points in the organization. Restaurant payments platform Toast has executed the multi-product strategy by adding payroll and workforce management capabilities. B2B marketplaces like Provi and Pepper created an additional revenue stream with advertising, while the solar installer platform Aurora Solar has found additional revenue through products that offer financing options. Construction services platform Procore has recently started offering insurance, leveraging their data insights across the lifecycle of a construction project.

Founder(s): Product Builders With Domain Experience

Unlike founders building in other parts of the AI stack, pure technologists attempting vertical AI are at a disadvantage to founding teams who have both domain experience and a technology background, especially those in regulated industries. This is even more pronounced for startups intending to sell to legacy organizations within verticals like healthcare, which are often bound by long-term contracts with dozens or hundreds of different entities at a time. Understanding these complexities intimately is crucial for establishing the right go-to-market strategy, projecting sales timelines, and hiring. For those who have deep domain expertise but may only have an inkling about a possible vertical approach, it’s not too early to get in contact with us. We are actively seeking out founders at the very beginning of their idea validation process to participate in our Edge program.

GTM: Create Urgency

Vertical sales cycles can be long, especially in large, established industries which are slow-moving and have less sophisticated technology buyers. It’s important that the GTM strategy has a unique way to create urgency or a path to dominate important distribution channels. Historically, successful vertical outcomes that didn’t have these elements spent many long years before traction started to take off.

The excitement around AI has created some urgency to try new products, but it can be both a headwind and tailwind. On one hand, AI is on every buyer’s mind, so it’s easy for new companies to line up a prospect call and even get customers on a trial. However, converting pilots to customers can be particularly challenging for fatigued users who are comparing multiple pilots against each other. Again, creating urgency for buyers to consider, convert, and use your product is key.

To convert swiftly, you should consider your core value proposition – we’ve heard from vertical market buyers that promising workforce efficiency gains or “innovation” (despite often selling to a innovation committee or Chief Innovation Officer) is not enough. It’s more effective to demonstrate how your product can drive incremental revenue or clearly cut costs.

Product: Beyond Copilots

Today, the dominant paradigm is a human paired with an AI copilot: humans do most of the work and AI copilots augment our capabilities. In the next few years, I expect to see more examples of the reverse. In a flipped model, AI agents will perform the majority of the work and humans will check and edit the outputs. I’m particularly excited about this emerging area as an entry point for startups, because co-pilots may be dominated by incumbents who already own distribution, whereas AI agents are a more greenfield opportunity. AI agents that can think, reason, and act on behalf of humans are also an exciting step to a fully autonomous future.

This paradigm shift will have massive implications for tomorrow’s businesses. As AI agents replace more skilled labor, spend on software will displace headcount expenses. In turn, I expect there to be novel usage or outcome-based pricing models which is another archetype to explore.

Vertical Opportunities

We believe AI is poised to transform virtually every industry vertical. Here, I’ll discuss three of the sectors I believe are particularly exciting.

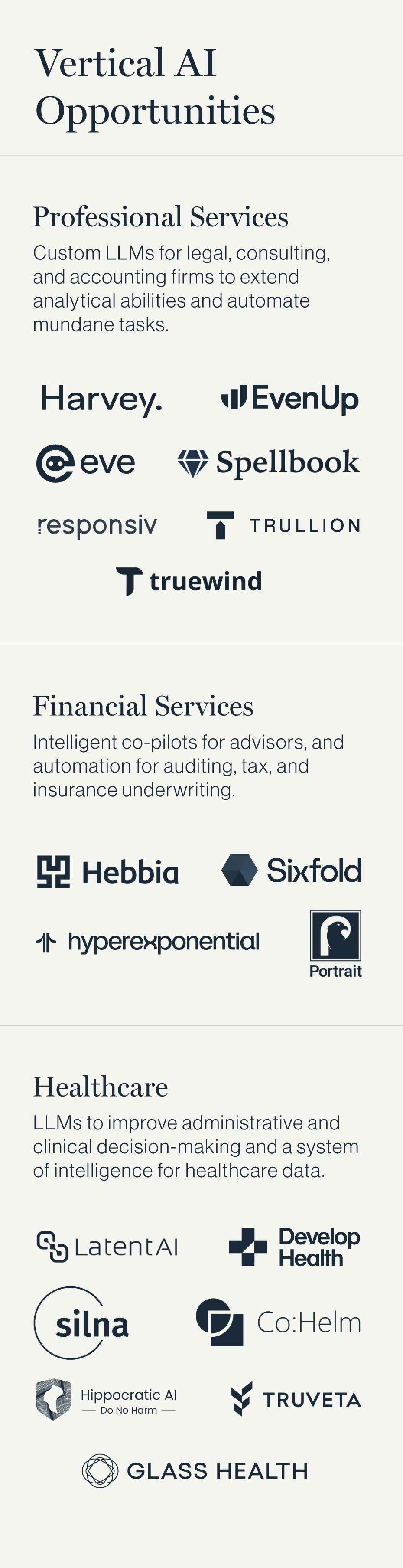

Professional Services

There are many verticals beset by laborious, manual workflows. Across legal services, accounting, and consulting, professionals spend considerable time reading, interpreting, and condensing critical information in order to turn around and respond with analysis, client communications, memos, and reports.

AI for legal services is one of those obvious verticals – the core product of law is language, and large language models are the basis of today’s platform shift. The legal market accounts for more than $300B in the U.S. alone, and there is a demonstrated interest in adopting AI: Large law firms have significant budgets to spend on software, many we interviewed indicated they would spend up to seven figures annually for transformative AI software. This has given rise to AI-first companies like Harvey, EvenUp, Eve, and Spellbook. Incumbents like Thomson Reuters, Relativity, and Ironclad are acquiring or incorporating AI into their existing products with Thomson’s $650m acquisition of Casetext as a recent example of a pricey offer for relatively early progress.

At Greylock, we recently invested in Responsiv, which provides AI assistants for in-house legal teams. The company has many attributes that align with our investing framework. First, the founders hail from legal tech backgrounds, having previously worked at Relativity. Next, the TAM is worthwhile: in-house is an underserved but quickly growing segment of the legal industry, accounting for nearly 80% of the $320B total in the U.S. In-house teams have specific needs that can be well-served by AI, including assistance in executing contracts/NDAs and augmenting the comparatively higher volume of generalist legal knowledge in-house teams require to that of specialist practitioners at law firms. Additionally, in-house legal teams are generally regarded as a cost center within an organization, meaning the enhanced efficiency AI can bring is more likely to be embraced than it might be at a law firm defined by a billable hours model.

Consulting and accounting is another field that is ready to embrace AI. The Big 4 consulting firms each hire 10s of thousands of consultants and accountants, an enormous workforce that can be massively augmented with AI. KPMG has committed to invest $2 billion dollars over five years on AI products and PwC will spend $1 billion dollars on generative AI over the next three years to automate aspects of its audit, tax, and consulting services. In a joint study by Harvard Business School and BCG, consultants using GPT-4 were found to complete tasks 25% faster with 40% improvement in outcome quality.

Accountants spend time understanding rules and policies to apply them to their calculations. In our interviews with accounting professionals, revenue recognition stood out as one of the most painful, recurring (monthly) – yet most automatable – use cases. Trullion automates this corporate accounting workflow and is a collaboration tool for CFOs, corporate controllers, and auditors. Truewind is approaching smaller businesses and aims to be the CFO for SMBs that don’t have one.

Financial Services

There are several attributes that make financial services well-suited to AI. The market is huge, with some $11 trillion of market cap in the U.S. alone, and there is demonstrated demand for AI tools. For example, in the past year, we saw the release of Bloomberg GPT, Morgan Stanley’s partnership with OpenAI, and Alphasense’s addition of AI-powered search and summarization tools to its market intelligence platform.

Looking at the daily responsibilities of investment professionals and wealth advisors, it’s easy to see where AI could be applied. The information is highly complex and involves both internal proprietary data as well as real-time market data and news; financial modeling and calculations require a mix of mathematical understanding and human judgment; and errors are costly – a single mistake in a model or diligence step could result in millions/billions dollar impact to the business. At the same time, professionals are tasked with numerous mundane, manual workflows that require little mental output but can eat up about a third of their time.

As my colleague Seth Rosenberg recently wrote, we see potential for a copilot for wealth managers which would assist them in day-to-day data collection and summarization, portfolio management, and communication with clients. Meanwhile, as co-pilots extend capabilities for the demanding, human knowledge portion of financial services, AI could automate the mindless parts of the job.

For startups, this is where both domain expertise and creative business models are crucial: general purpose LLMs like ChatGPT are far from being able to handle complex financial tasks, so founders with financial backgrounds are at an advantage. Another angle is catering to smaller financial organizations that don’t have the capabilities to directly invest in building on top of OpenAI, and would more likely be buyers of an off-the-shelf application to serve similar needs.

Hebbia, Sixfold, Hyperexponential, and Portrait Analytics are a few AI-native startups that are making some exciting progress as well. Large financial institutions are using Hebbia to streamline their diligence and understand complex data rooms. Portrait Analytics is building a conversational financial analyst that has access to real time market data. In the world of insurance, new startups like Hyperexponential (hx) and Sixfold are leveraging complex data to create sophisticated insurance pricing models and automate underwriting workflows.

Healthcare

People have been talking about AI’s potential impact on healthcare for years, but it has never been as tangible as now. Previous software efforts attempted to codify unstructured data into a usable format, which wasn’t always scalable across the various, disparate legacy IT systems that make up healthcare organizations. LLMs’ ability to work with unstructured data as it is could have a profound effect on both the clinical and administrative side. LLMs could improve diagnostics or decision-making models, and can give rise to platforms that automate insurance claims; and overall better management of healthcare data.

I’ll outline 3 AI healthcare use cases in order of maturity: transcription and documentation, prior authorization, and clinical reasoning models.

The first and most clear use case is transcription and documentation. While there have been several attempts over the years, a clear winner is yet to emerge, owing to the commoditized nature of transcription tools and the necessity for a human being to read, interpret and codify the results.

Now, LLM-based applications can exponentially improve on past generations of AI scribe tools by applying human-like judgment, which is key to unlocking higher-value use cases like transforming unstructured data into structured data to enter in an EHR, identifying medical codes, and referencing past interactions. There are a number of AI-native entrants in this category like Ambience, Abridge, and DeepScribe, which capture real-time clinician-patient conversation, and Greylock portfolio Notable Health, which automates patient intake, handling registration, scheduling, and authorizations at scale.

However, founders building at this layer should be cognizant that this area is becoming increasingly saturated. To truly own this layer, LLM applications must be architected as a platform to generate enough valuable data to serve as the glue between disparate data streams. This system of intelligence could vastly improve on the legacy EMR/EHR incumbents.

The second emerging use case for LLMs in healthcare is solving the broken provider-payer relationship by focusing on the prior authorization flow, which in the U.S. is currently a cumbersome workflow between doctors and insurers to ensure that a patient’s service, treatment, or medication can be covered by their plan. On the provider side, using LLMs to automate prior auth claims is a burnout and administrative efficiency gain, freeing up physicians time to treat more patients. On the payer side, prior auth has historically been outsourced to vendors who solve with manual human labor. Automating claims on the payer side would not only be more cost-effective than the vendor solution, but also a more strategic technology asset that could assess adverse patterns at scale and handle complex counterclaims and rebuttals. We’re watching a number of startups going after this opportunity like Latent, Develop, Silna, and Co:Helm. This is a deeply complex challenge we also believe is best served by a system of intelligence approach. Given Greylock’s long history partnering with founders who have excelled at building platforms, we are especially excited to work with entrepreneurs with this go-to-market strategy.

The final use case I’ll describe is the most nascent, but potentially the most transformative: a medical LLM capable of clinical reasoning – a model that could diagnose and provide medical guidance would be the gold standard. Google’s Med-PaLM 2 has a lead on others and is capable of answering complex medical questions, and has successfully answered questions posed on medical certification exams. Building a medical LLM is a highly ambitious endeavor that will take significant time and resources to achieve, but we believe it is an important enough goal to warrant the support of a wide range of investors. We’re already seeing promising efforts in this early and dynamic space with new entrants like Hippocratic, Truveta, and Glass Health.

Conclusion

We are at the early innings of an incredible period of innovation. We believe vertical specialization and domain-tuned AI can be a successful way to achieve durability, which is a critical concern for AI at the application layer.

I’ve highlighted just a handful of the verticals I see as the most promising for AI innovation, but we are actively looking for opportunities to build valuable companies in dozens of verticals with various business models – especially at the very earliest stages. If you’re building vertical AI businesses, I’d love to hear more. You can reach me at christine@greylock.com.